Master Customer Acquisition Cost Calculation

Before we get into the nuts and bolts of the formula, let’s talk about why your Customer Acquisition Cost (CAC) is so much more than another number on your dashboard. Think of it as the pulse of your business's financial health.

Getting your customer acquisition cost calculation right is what separates blindly spending on growth from strategically investing in real, sustainable profitability.

Why Mastering Your CAC Is a Game-Changer

Understanding your CAC gives you a powerful lens to evaluate every marketing campaign, sales strategy, and pricing decision you make. It cuts right to the heart of the matter and answers the most critical business question: Are we spending our money wisely to bring in new customers?

Without a clear answer, you're just flying blind. You might be pouring cash into channels that look busy on the surface but are actually delivering completely unsustainable results.

This isn’t just some theoretical exercise. Getting a customer’s attention today costs more than ever before. In fact, the average CAC has skyrocketed by 222% between 2013 and 2025, jumping from around $9 to $29 per new customer. You can see more stats on rising acquisition costs from Amra & Elma. That massive spike highlights a hard truth: inefficient acquisition strategies are becoming a luxury no business can afford.

From Simple Metric to Strategic Lever

Once you have a firm grip on your CAC, you unlock a much deeper level of strategic planning. You stop just tracking expenses and start making sharp, informed decisions that directly boost your bottom line.

A clear picture of your CAC empowers you to:

- Allocate Budgets Effectively: You can confidently pour fuel on the fire for high-performing channels and cut the dead weight from those with a poor return.

- Refine Your Pricing Strategy: Knowing precisely what it costs to land a customer helps you set prices that guarantee profitability over their entire lifetime with you.

- Optimize Your Sales and Marketing Funnel: A high CAC can be a red flag, pointing to friction points in your funnel—anything from weak ad copy to a clunky checkout process.

Treat CAC as a diagnostic tool, not just a reporting figure. It’s what gives you a real competitive edge, helping you build a scalable business model instead of just a temporary spike in customer sign-ups.

Ignoring this number can lead straight to the "growth at all costs" trap—a dangerous path where revenue might be climbing, but your profits are actually shrinking. We've seen plenty of promising startups stumble because they overlooked this fundamental equation. It's all about moving beyond outdated tactics, a shift we explore in our guide on why cold outreach doesn't work anymore.

Ultimately, a precise customer acquisition cost calculation is the bedrock of sustainable growth. It ensures every single dollar you spend is helping build a resilient and profitable business.

Breaking Down the Foundational CAC Formula

At its heart, the customer acquisition cost calculation is refreshingly simple. It's built to answer one fundamental question: How much does it really cost us to bring a single new customer into the fold?

The basic formula is your starting point. It cuts through the noise to give you a quick health check on your entire acquisition engine. While CAC is our focus here, it's closely related to another key metric you might have heard of. For a deeper dive, you can explore this guide on how to calculate Cost Per Acquisition (CPA).

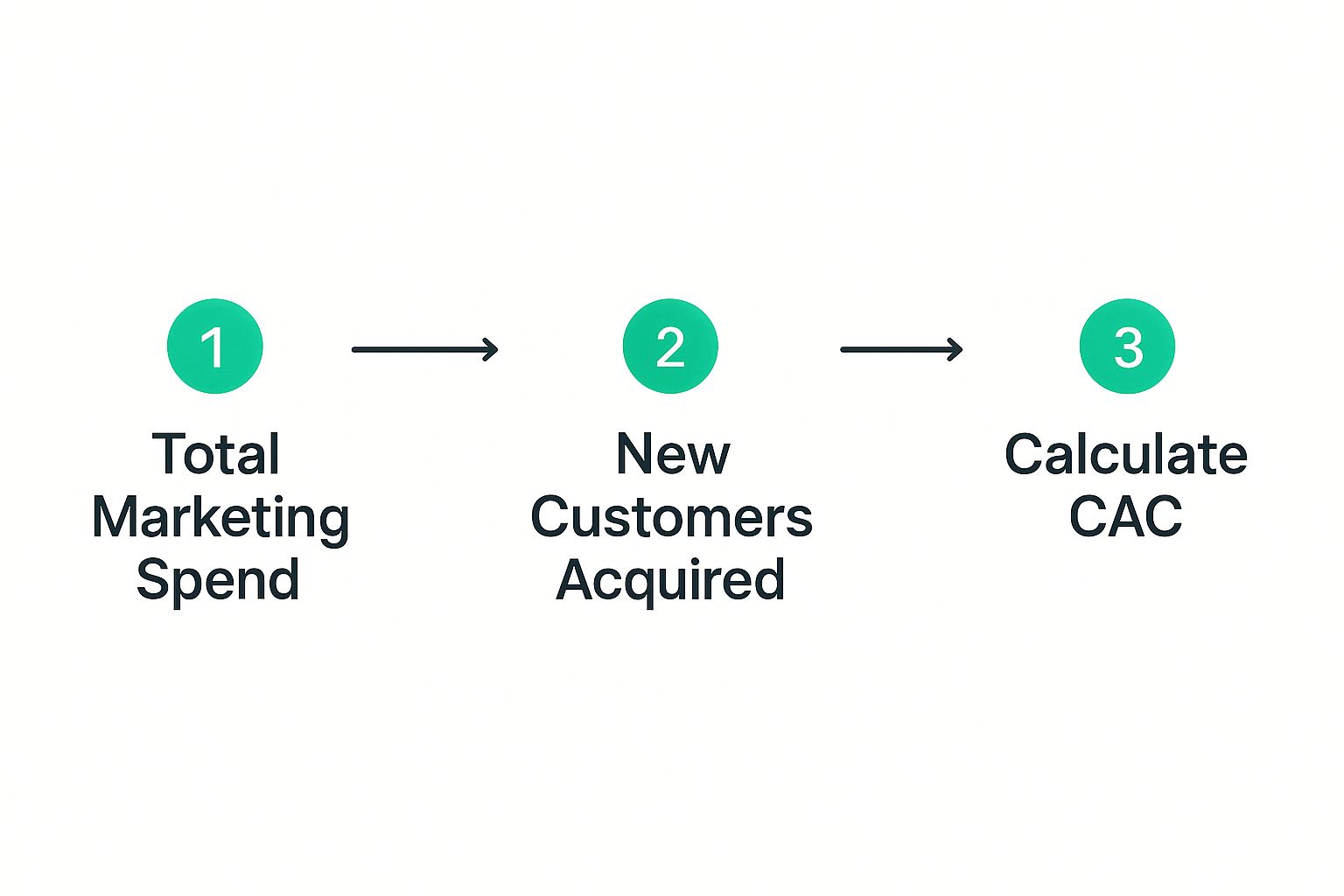

This infographic lays out the straightforward flow of the calculation.

As you can see, it’s a direct path from adding up all your costs to counting your new customers, which gives you that final CAC number.

Getting a Grip on Your Total Costs

The first half of the equation—Total Sales & Marketing Costs—is where most people trip up. It’s easy to just grab your monthly ad spend and call it a day, but that will give you a dangerously rosy, and flat-out wrong, CAC.

To get a true picture, you have to be brutally honest and incredibly thorough. This means tallying up every single dollar spent to win new customers over a set period. We're talking about everything from Google Ads and content creation to your sales team's salaries and the software they use every day.

To make sure you're not missing anything, it helps to have a checklist. This table breaks down the essential expenses you absolutely need to include for an accurate CAC.

Essential Cost Inputs for Your CAC Calculation

| Cost Category | Specific Examples | Why It's Included |

|---|---|---|

| People Costs | Salaries, commissions, and bonuses for your sales and marketing teams. | These are often the largest expense and are directly tied to the effort of acquiring customers. |

| Advertising Spend | All money spent on platforms like Google, Meta, LinkedIn, X, etc. | This is the most direct cost of reaching potential customers through paid channels. |

| Tools & Software | Subscriptions for your CRM, marketing automation, analytics software, etc. | These tools are the infrastructure that supports your sales and marketing operations. |

| Content & Creative | Fees for graphic designers, video producers, freelance writers, or agencies. | The costs to create the assets used in your campaigns are part of the acquisition effort. |

| Overhead | A portion of rent or office expenses allocated to sales/marketing teams. | While sometimes harder to track, this reflects the true operational cost of your teams. |

The bottom line is to include any and all expenses that contribute to your customer acquisition machine. Being honest here is non-negotiable if you want a number you can actually trust.

Nailing Down What "New Customer" Means

The other side of the formula is dividing all those costs by the Number of New Customers Acquired. This sounds easy enough, but defining what counts as a "new customer" is critical for accuracy.

First things first, make sure the timeframe for counting new customers perfectly matches the period you used for your costs (e.g., last month, last quarter).

A "new customer" is someone who made their very first purchase or signed their first contract within that specific window. You have to be careful not to lump in returning or existing customers here—that will make your CAC look much better than it actually is and lead to bad decisions. Your CRM should be your source of truth.

Let’s walk through a quick, tangible example. Imagine a B2B software company calculating its CAC for Q2.

- Total Q2 Sales & Marketing Spend: $50,000

- New Customers Acquired in Q2: 500

The math is simple:

$50,000 / 500 = $100 CAC

This tells the company that, on average, it spent $100 to acquire each new customer during the second quarter. This baseline number is the crucial first step before you can start digging deeper and getting strategic.

Finding the Right Data for an Accurate Calculation

Here's a simple truth: your customer acquisition cost calculation is only as reliable as the numbers you feed into it. Garbage in, garbage out. If you use incomplete or messy data, you’ll get a misleading CAC that could lead you to make some seriously flawed budget decisions.

The goal isn't just to get a number; it's to get the right number. This means creating a repeatable process for gathering clean, comprehensive data every single time. Your financial puzzle pieces are likely scattered across a handful of different platforms, so think of this as a data scavenger hunt. You need to know exactly where to look.

Pinpointing Your Cost Data Sources

To get a complete picture of your total acquisition spend, you'll need to pull information from a few different corners of your organization. Unfortunately, there's no magic "CAC report" button that has everything you need, so being diligent is non-negotiable.

Your primary sources of truth will typically include:

- Ad Platforms: This is the most straightforward part. You’ll pull spending reports directly from places like Google Ads, Meta Business Suite, and LinkedIn Campaign Manager.

- Accounting & Payroll Software: This is where you'll track down the salaries, commissions, and bonuses for your sales and marketing teams. Don't forget to include the "loaded" costs like payroll taxes and benefits.

- Expense Reports & Invoices: Dive into your accounting system to find one-off costs. Think freelance writer invoices, creative agency fees, or subscriptions to essential tools like your CRM and analytics software.

Organizing Your Data for Consistency

Once you know where to find your numbers, the next step is to get them all in one place. A simple, shared spreadsheet or a dedicated dashboard works perfectly for this. The whole point is to create a single source of truth that you can update consistently, whether you calculate CAC monthly or quarterly.

This central hub ensures everyone on the team is working from the same figures. It also makes it incredibly easy to track how your customer acquisition costs change over time. It transforms the task from a frantic data-gathering mission into a simple, routine update.

A classic mistake is misattributing sales or forgetting "soft" costs like a portion of overhead. Be ruthless in your accounting; every dollar spent to attract a new customer—from a salesperson's salary to a software subscription—has to be included for an accurate picture.

Avoiding Common Data-Gathering Pitfalls

Even with the best intentions, it's easy to make small mistakes that completely skew your final CAC number. One of the most common errors I see is forgetting about the "people costs" that go beyond base salaries, like performance bonuses or commissions that were paid out during that specific period.

Another classic pitfall is failing to align the timeframes perfectly. The expenses you include must match the exact period in which you acquired the new customers. Using last quarter's ad spend with this month's new customer count will give you a completely meaningless result.

By creating a standardized checklist and a central tracking document, you can sidestep these unforced errors and build a CAC calculation you can truly trust.

Digging Deeper with Advanced CAC Calculations

Calculating a single, blended customer acquisition cost is a great first step. It gives you a quick snapshot of your business’s health. But the real, game-changing insights come when you start slicing that number into smaller pieces. This is where you go from a simple check-up to a full diagnostic of your entire marketing engine.

A blended CAC averages everything together, which means it hides your star performers and your most expensive drains. Let's say your overall CAC is a respectable $100. It’s easy to look at that number and think everything is running smoothly.

But what if a deeper look reveals your content marketing efforts bring in customers for just $20, while your paid search campaigns are costing you $250 per acquisition? Without segmenting, you'd never spot this massive difference and would probably keep funding both channels the same way.

Calculating CAC by Marketing Channel

The most powerful way to start is by figuring out the CAC for each of your marketing channels. This process isolates the performance of strategies like Google Ads, content marketing, or social media campaigns, showing you their true return on investment.

To do this right, you have to meticulously track your costs and connect new customers back to their specific source.

- Isolate Channel-Specific Costs: Tally up every expense directly tied to a single channel over a set period. For Google Ads, this isn't just your ad spend—it also includes any agency fees or the salaries of the PPC specialists managing the account.

- Attribute New Customers: Use your analytics tools and CRM to accurately figure out how many new customers came from that specific channel during the same timeframe.

- Do the Math: Just divide the total channel costs by the number of new customers it brought in.

For example, if you spent $10,000 on LinkedIn ads in one quarter and got 50 new customers directly from those campaigns, your LinkedIn CAC is $200. When you compare that $200 figure to your content marketing CAC of $20, it’s immediately obvious where your budget could be reallocated for a much bigger impact.

Uncovering Opportunities with Geographic and Persona Segmentation

It doesn't stop with channels. Segmenting your CAC by geography or customer persona can uncover huge, hidden growth opportunities. Your ideal customer in one region might behave completely differently than in another, and your acquisition costs will absolutely reflect that.

For instance, you might find that your CAC for enterprise clients is $1,000, while for small business clients, it's only $150. That insight could push you to create more targeted campaigns for the SMB market or refine your enterprise strategy to justify the higher cost. You can get even more sophisticated here, using AI to pinpoint these high-intent leads more efficiently. You can learn about this in our complete guide to AI lead generation tools.

The whole point of segmentation is to find pockets of efficiency. A lower CAC in a specific channel, region, or persona is a clear signal from the market telling you, "This is working. Do more of this."

This is especially true for businesses operating globally. Regional economic conditions and consumer habits can dramatically affect acquisition costs. In 2024, for example, the average cost per install—a common stand-in for CAC in the mobile world—was $5.28 in North America, but just $1.03 in Europe and $0.93 in the Asia-Pacific region. Finding out your CAC in a new market is a fraction of what you pay at home could completely reshape your global expansion strategy. You can discover more insights about these regional CPA statistics and how they vary.

Turning Your CAC Insights into Action

Knowing your customer acquisition cost is a great start, but it's only half the battle. The real magic happens when you use that number to make smarter, more profitable decisions for your business. A standalone CAC figure is just data; it's when you pair it with other key metrics that it becomes a strategic roadmap for sustainable growth.

The most critical relationship you need to understand is the one between your CAC and your Customer Lifetime Value (LTV). Simply put, LTV is the total revenue you can reasonably expect from a single customer over the entire time they do business with you. This comparison is what truly tells you if your acquisition strategy is healthy or on life support.

Understanding the LTV to CAC Ratio

The LTV to CAC ratio is the ultimate stress test for your business model's viability. It answers one simple but vital question: Are we making more money from our customers than we're spending to get them in the door?

For most industries, a healthy LTV:CAC ratio is widely considered to be 3:1 or higher. That means for every dollar you spend bringing in a new customer, you’re generating at least three dollars in lifetime value. Pretty good, right?

A ratio below 1:1 is a massive red flag. It means you're literally losing money on every new customer you sign. If you're hovering somewhere between 1:1 and 3:1, you might be breaking even or turning a tiny profit, which is still a precarious place for a growing company to be.

This ratio gives you the context you need to turn your customer acquisition cost calculation into a powerful tool. It tells you whether you have the green light to ramp up your marketing spend or if you need to hit the brakes and focus on efficiency.

Proven Strategies to Lower Your CAC

If your LTV:CAC ratio isn't looking so hot, the most direct fix is to lower your CAC. This doesn't mean you have to slash your budget into oblivion. It’s about making every dollar you spend work harder and smarter.

Here are a few proven tactics I’ve seen work time and again to make acquisition efforts more efficient:

- Optimize Your Conversion Funnel: A leaky funnel is like a hole in your wallet—it’s a massive drain on your budget. Small tweaks can lead to huge improvements in your CAC. Once you've got your CAC calculated, a crucial next step is to dig into effective conversion rate optimization tips to make sure your marketing spend is delivering the best possible results.

- Invest in Organic Channels: Paid ads are great for quick results, but they can get expensive fast. Putting resources into long-term organic channels like SEO and content marketing often delivers a much lower CAC over time. Your content assets keep working for you, attracting customers long after you’ve paid to create them.

- Launch a Customer Referral Program: Your happiest customers can be your most effective—and cheapest—sales team. A well-designed referral program gives them an incentive to spread the word, bringing in high-quality leads for a fraction of what you'd spend on other channels.

- Refine Your Lead Generation: Focusing your energy on higher-quality leads means your sales team isn't wasting time on prospects who were never going to convert anyway. Improving your targeting is a fundamental first step, and you can learn more about that in our beginner's guide to B2B lead generation.

By actively working to improve your CAC, you're doing more than just cutting costs. You're building a more resilient, efficient, and profitable growth engine that can stand the test of time.

Common Questions About Calculating CAC

Even when you've got the formula down, a few practical questions always pop up when it's time to actually calculate your customer acquisition cost. Getting these details right is the difference between a fuzzy metric and a number you can confidently use to make smarter business decisions.

Let's tackle some of the most common ones I hear.

How Often Should I Calculate My Customer Acquisition Cost?

For most businesses, especially if you're in a fast-moving space like SaaS or e-commerce, calculating CAC on a monthly or quarterly basis is the sweet spot. This rhythm gives you quick feedback on your recent marketing campaigns, letting you make agile adjustments to your strategy and budget before too much time passes.

An annual calculation can still be useful for spotting long-term trends or for high-level strategic planning. But for the kind of tactical, month-over-month optimizations that really drive efficiency, it's just too slow.

What Is a Good CAC for My Business?

This is the million-dollar question, and the honest answer is: it depends. There's no universal "good" CAC that fits every company. A healthy number is completely relative to your business model and, most importantly, your Customer Lifetime Value (LTV).

A sustainable CAC is simply one that's significantly lower than your LTV. The widely accepted benchmark for a healthy business is an LTV:CAC ratio of at least 3:1. This means for every dollar you spend to bring in a new customer, you're getting three dollars back over their lifetime with you. An enterprise software company can easily afford a much higher CAC than a direct-to-consumer brand selling t-shirts.

Stop looking for a magic number. Instead, focus on the relationship between what you spend to get a customer and what you earn from them. Your LTV:CAC ratio is the true health meter for your acquisition engine.

Which Salaries Should I Include in the Calculation?

This is a common tripwire that can seriously inflate your CAC if you get it wrong. The rule of thumb here is pretty straightforward: only include the salaries and commissions for employees who are directly involved in acquiring new customers.

This almost always includes:

- Your marketing team members running campaigns and creating content.

- Your sales team members who are actively prospecting and closing deals.

It's critical to exclude salaries from departments like product development, engineering, or customer support. While these teams are absolutely vital, their main job isn't bringing in new customers. Tossing their compensation into the mix will bloat your CAC and give you a misleading picture of your marketing and sales efficiency.

Ready to stop guessing and start finding high-intent customers? Intently uses AI to monitor online channels and deliver qualified leads directly to you, helping you lower your CAC by focusing only on prospects ready to buy. Discover how Intently can refine your lead generation strategy today.